The Elephant VS The Dragon

India is developing

into an open-market economy, yet traces of its past autarkic policies remain.

Economic liberalization measures, including industrial deregulation,

privatization of state-owned enterprises, and reduced controls on foreign trade

and investment, began in the early 1990s and served to accelerate the country's

growth, which averaged fewer than 7% per year from 1997 to 2011. India's

diverse economy encompasses traditional village farming, modern agriculture,

handicrafts, a wide range of modern industries, and a multitude of services.

Slightly less than half of the work force is in agriculture, but, services are

the major source of economic growth, accounting for nearly two-thirds of

India's output with less than one-third of its labour force.

Since the late 1970s

China has moved from a closed, centrally planned system to a more

market-oriented one that plays a major global role - in 2010 China became the

world's largest exporter. Reforms began with the phasing out of collectivized

agriculture, and expanded to include the gradual liberalization of prices,

fiscal decentralization, increased autonomy for state enterprises, growth of

the private sector, development of stock markets and a modern banking system,

and opening to foreign trade and investment. China has implemented reforms in a

gradualist fashion. In recent years, China has renewed its support for

state-owned enterprises in sectors considered important to "economic

security," explicitly looking to foster globally competitive industries.

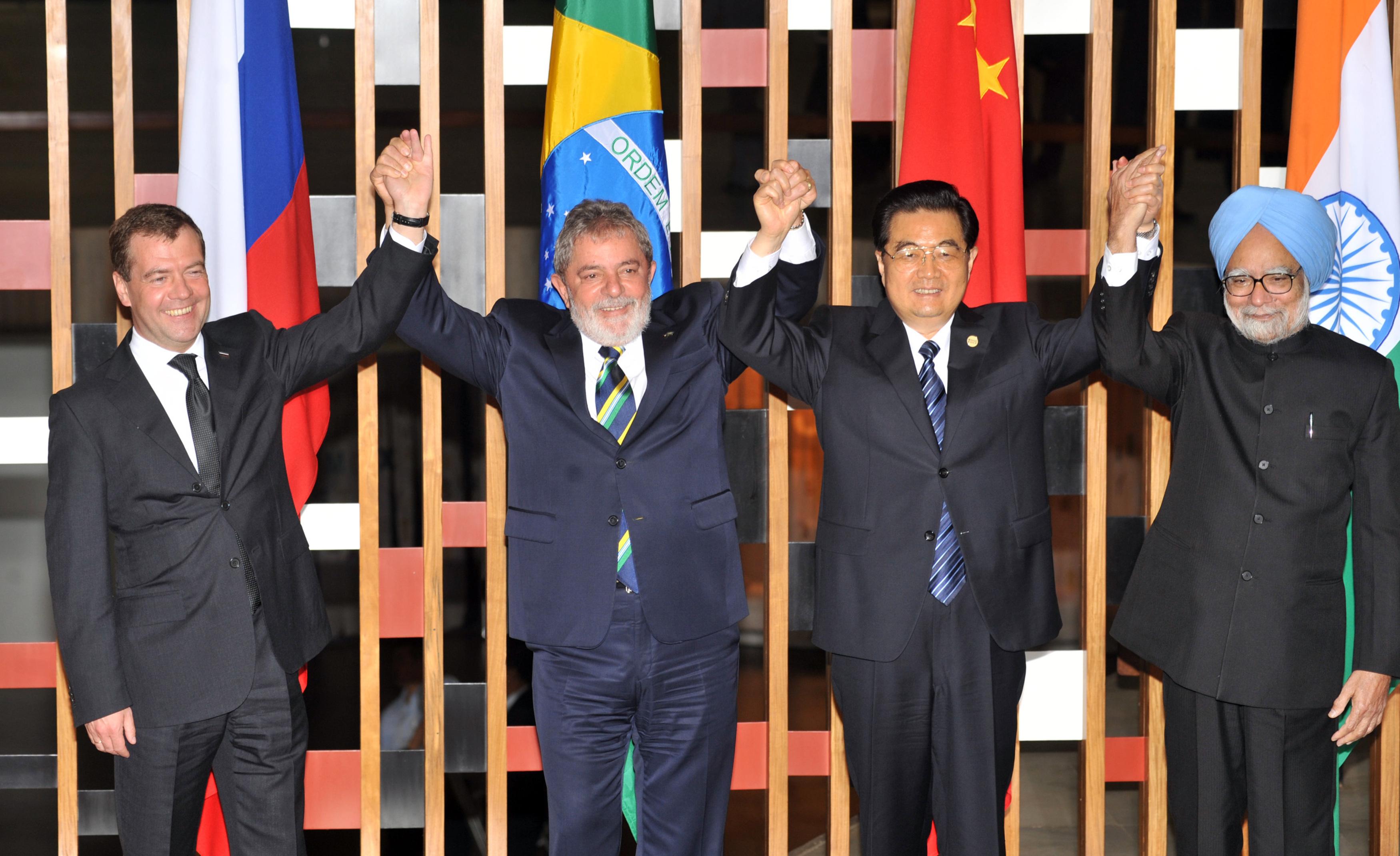

BRIC:

a brief overview of the new economic powerhouses in 2030

Many analysts believe

the fate of the future global economic systems will fall into the hands of not

only India and China, but Russia and Brazil, as well. The economic growth of

these "BRIC" countries up through 2030 is overwhelming. Their real

GDP will grow by 7.9% p.a. over the next 20 years. The emerging equity markets

will grow significantly by 9.3% p.a. to USD 80 trillion by 2030, while global

equity market capitalization (in fixed 2010 USD) will increase. Real GDP

proportions in 2010 and 2030 (Source: Goldman Sachs; EIU; IMF; MIGA; World

Bank; Roland Berger).

The purchasing power of

billions of people in the BRIC markets will increase significantly by 2030.

China's real GDP will grow by 7.9% p.a. over the next 20 years, much faster

than over the past 20 years (5.6%). The BRIC countries will generate 36% of

global GDP in 2030, compared to today. The annual real GDP growth rate will be

the strongest at 9.0%, followed by India (8.4%), Brazil (5.5%) and Russia 8%

(5.3%). China will overtake the United States to become the world's largest

economy by the mid to late 2020s. India's will be one economy in 2030,

accounting for 5.7% of the world's GDP.

Brazil will overtake

Japan in 2030. Real exports of the BRIC countries will increase at the same

rate as their GDP at 7.8% p.a. –- quarter the size of the Chinese i.e. faster

than the average for the developing countries (6.7% p.a.), but slower than over

the last 20 years (10% p.a.). The BRIC countries' share of global exports (23%)

will be almost on a par with that of Europe. Today it is only 14%, up from 5.8%

in 1990. China and India will become the global suppliers of manufactured goods

and services, Brazil and Russia of raw materials. India's real exports will

grow the fastest at 13% p.a. up to 2030, followed by China (7.1%), Brazil

(6.5%) and Russia (4.9%). China will generate 14% of the world's export, India

6.4%.

All the BRIC countries

will still be among the world's most attractive locations for FDI in 2030, due

to their prospects for economic growth and wealth in resources. The strongest

FDI growth rates are expected for India, followed by Brazil, Russia and China.The

reason for China's slower growth is the strong basis it already has today (9% of world FDI). As India catches up to China, it

around 70% of China's FDI inflows as early as 2014.The road to global prosperity

will eventually go through.

STATS

|

China

|

India

|

Business >Companies >Corporate governance

(overall rating)

|

3.37

Ranked 34th. |

4.54

Ranked 20th. 35% more than China |

Business >Companies >Specific companies > Carrefour

> First store

|

1,995

Ranked 20th. |

2,010

Ranked 3rd. 1% more than China |

Debt >

Government debt >Gross government debt, share of GDP

|

22.85 IMF

Ranked 142nd. |

66.84 IMF

Ranked 43th. 3 times more than China |

Debt >

Government debt >Public debt, share of GDP

|

31.7 CIA

Ranked 110th. |

49.6 CIA

Ranked 64th. 56% more than China |

Debt > Interest

rates > Central bank discount rate

|

6%

Ranked 60th. |

7.5%

Ranked 48th. 25% more than China |

Government >Revenue > Tax >Taxes foreign income

of nonresident citizens

|

no

|

no

|

Government >Revenue > Tax >Taxes foreign income

of resident foreigners

|

yes

|

yes

|

Government >Revenue > Tax >Taxes local income

of nonresident individuals

|

yes

|

yes

|

Government >Revenue > Tax >Taxes local income

of resident foreigners

|

yes

|

yes

|

Size of economy >Share of world GDP

|

3.47%

Ranked 5th. 2 times more than India |

1.45%

Ranked 11th. |

Comments

Post a Comment